SMI Core data captures the actual spend data from the SMI Pool partners of major holding companies and large independent agencies, representing up to 95% of all US national brand ad spending, to provide a complete monthly view of the SMI Pool market size, investment share and category performance. Core Data delivers detailed ad intelligence across all media types, including Television, OTT, Digital, Out of Home, Print, and Radio.

Topline Insights

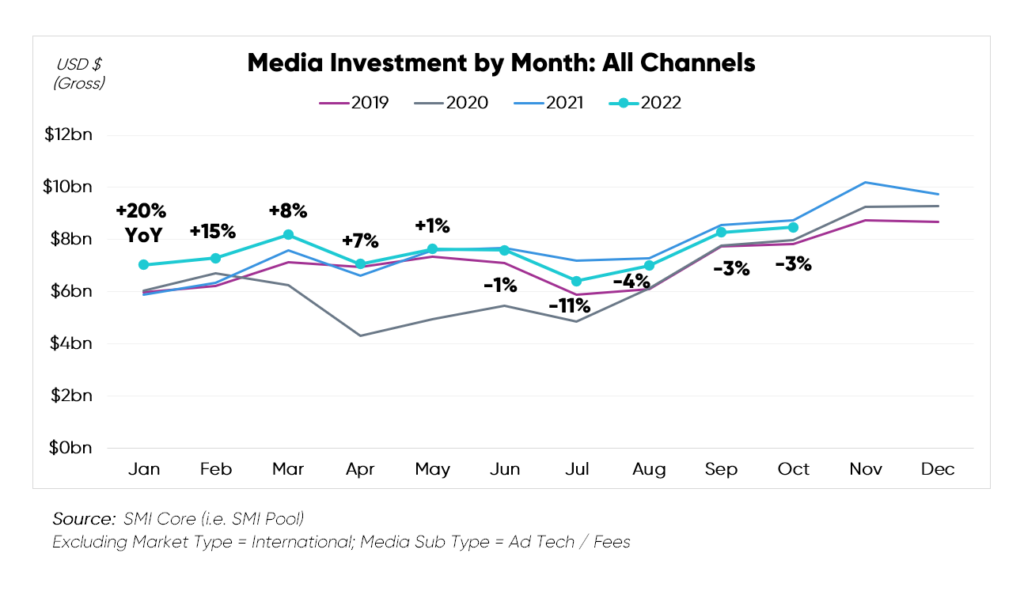

October advertising investment fell -3% YoY, declining for the fifth consecutive month. However, perched at $8.5bn, October spending outperformed all other months in 2022, as the holiday push historically attracts advertisers.

Although the market is down compared to last year, SMI sees this less as recessionary fears and more as the ad sector normalizing from an overly hot last year. In the last months of 2021 and even Jan-Feb 2022, advertisers were spending ~20% up over 2020, whereas “normal” ad market growth for decades was in the 2-5% realm. This October is still up a healthy +6% compared to 2020 and +8% over 2019.

Insights by Media Type

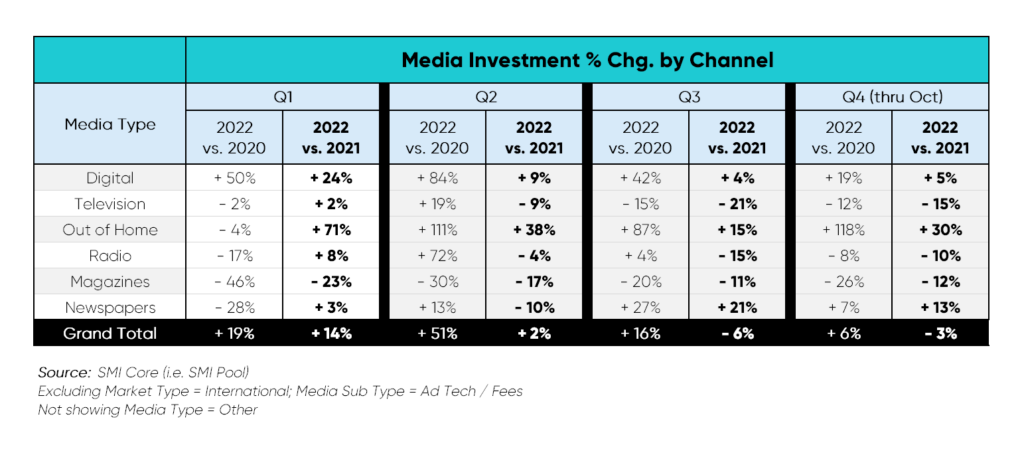

Prelim Q4 2022 (thru Oct.)

Linear TV spending deflated at the fastest rate, while Digital expanded, gaining 5% points to represent a 57% share of ad dollars in October.

Out-of-Home media type grew most rapidly. Nine out of twelve Product Category Groups beefed up spending during Prelim 4Q 2022. Entertainment & Media, Apparel & Accessories, and Auto sectors led the pack in raising investment levels in support of OOH.

Newspaper investment newly expanded, breaking four consecutive years of divestment in the period.

Insights by Media Owner

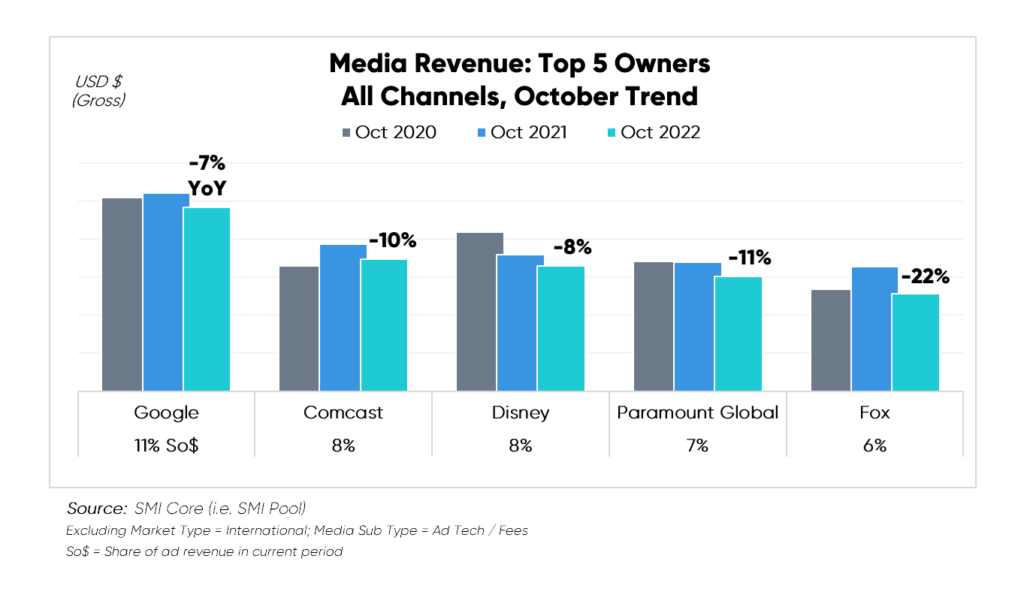

Linear TV (-15%) and Digital Search (-16%) continued to lag YoY. These declines in ad revenue carried over to each of the top five media companies.

Paramount ad dollars eroded for the second year in a row, while the other Media Owners newly entered negative territory during the month.

Google maintained the largest share of ad dollars with Digital Search representing the majority share of that revenue. Google ad revenue took a downturn for the first time on record, during October.

Fox felt the sharpest decreases with drops in Broadcast TV (-23%) and Cable TV (-10%) vs. October 2021. Fox received pull-back from eight out of twelve Product Category Groups.

Insights by Product Category Group

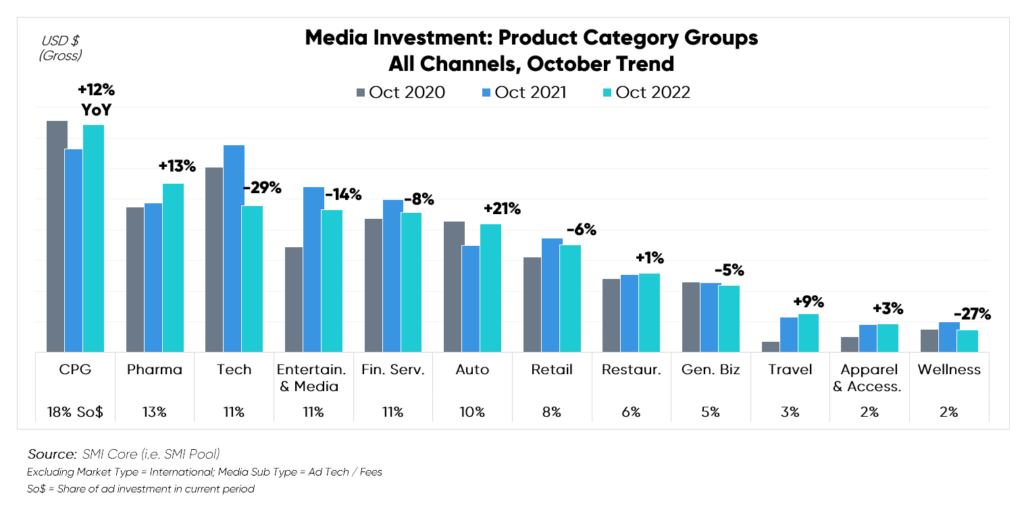

Six Product Category Groups grew investment in October, while the remaining six tightened the purse strings.

Notably, four Category Groups (i.e., Pharma, Restaurants, Apparel & Accessories and Travel) experienced the best October on record, tracking back to 2017.

Technology took the largest hit in October, pulling back investment by nearly -$400MM. Steady declines began chipping away at overall spending in April 2022 with the heaviest fallout coming from Telecom.

Like the prior two months, Automotive continued ramping up investment with the second highest lift in ad spend, next to CPG which continued to rank first and contributed the most additional dollar volume.