Recession Planning, Part 4: Brands, know your fundamentals and keep goals flexible

Part 4 in a 4-part series on recession planning for advertising

By John Spiropoulos

The advertising world all comes back to the advertisers. Rounding out our four-part series on planning for a recession in the advertising industry, we consider here strategic marketing priorities for brands themselves.

The advertising world all comes back to the advertisers. Rounding out our four-part series on planning for a recession in the advertising industry, we consider here strategic marketing priorities for brands themselves.

As we discussed in Part 2 of this series, a general rule of recessionary periods is that the mix of media is liable to change rapidly, due to new technologies and changing habits by consumers and advertisers. What does this mean for brands in terms of planning for the 2022-2025 period?

Know Your Fundamentals

Importantly, specific advertiser product categories can be uniquely impacted by a recession based on what instigates the economic malaise. Beyond this impact, it boils down to two key constructs:

- Margin on product sales

- Category share

The latter can be further refined by coupling it with brand goals during the recessionary period. There’s always a brand here-and-there that will increase its share of voice to incrementally gain market share. However, this is a bit of guesswork as it’s a strategic decision by each brand.

Fundamentals include knowing your competition and their fundamentals. Consider those with like-for-like targets but also those with lower- or higher-income targets.

Additionally, a key metric is gauging ad spend per dollar of revenue (or units sold). Higher values on this metric, within a competitive set of brands, allows the brand to cut spend without a (relative) sacrifice to brand goals (just media frequency).

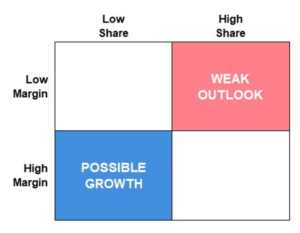

The Marketer Recession Impact Quadrant

The concept sketch below is meant as a broad indicator of possible recessionary impacts for different types of marketers. It is not gospel, and outliers abound (discussed later). But a quick review paints a clear picture, which can be adapted to any product category (a.k.a., a competitive set of brands):

High Share-Low Margin: Weak Outlook

Brands in this quadrant are category leaders that drive overall revenue through operational efficiencies. The operational ability is tied to sales volume. In today’s inflationary economy, where demand is robust, these brands remain resilient as producer price increases are generally being passed along to consumers. But a recession implies a sharp hit to demand, which is already inflated from our current economic environment.

These are generally large marketers who make up a disproportional amount of the client base of large media publishers. A hit here will see steep short-term pull-back with significant ripples through large publishers.

Low Share-High Margin: Possible Growth

In the 21st century, growth usually requires a certain “digital something.” Brands in this category today are generally direct-to-consumers brands with digital storefronts. They have high price-points targeting higher-income households. Their consumers are the most resilient to economic woes.

Usually, these brands are generally small-to-medium national marketers. Their focus is nearly always on performance over branding. They are Digital-first if not Digital-only in terms of media selection. This is the most likely group to make strategic investment decisions to gain market share by increasing their share-of-voice.

Low Share-Low Margin: Specialists Outside of Paid Media

This is the weakest group of brands in each product category. When sales struggle, the marketing budget can all but dry up as way to offset those sales declines. These brands are hyper-focused on performance marketing and will foray further into Influencer and earned media.

High Share-High Margin: The “What Recession?” Group

These are the elite brands in the marketplace. Even if they feel an impact from recessionary woes, it’s much more limited than others. In fact, in terms of household budgets, they’re likely to gain share as consumers refocus on their personal priorities. For instance, we all know someone who would budget less for food than miss out on the latest iPhone.

The main goal of these marketers is branding. They will adjust media mixes for pricing efficiencies if those branding goals are met. They may also risk losing a little market share if budget constraints occur in corporate planning cycles.

Expect Some Routine Recessionary Trends

Strong economic periods lead to brands experimenting with customization, versions/flavors, and other brand extensions. These brand options and efforts cost a considerable amount, particularly for low-margin CPG brands. It follows that economic weakness, even the fear of unrealized weakness, will lead to a product consolidation.

This isn’t just for consumer products. Consolidation occurs with sales promotion for any product category from retail to fast food. Importantly, these are generally low-margin businesses as well.

What the ad market can expect from brands:

- Consolidated marketing campaigns

- Fewer flavors and brand variants

- Reduced product customization (or at a greater cost to consumers)

- Fewer sales and promotional periods

- More significant goals required from campaigns

- Relative increase in offers during sales and promotional periods

- Flexibility of media selection (benefitting publishers with varied ad products)

- Target re-alignment to higher-income households

- Greater trade-off from paid search to more eCommerce

What brands will expect from the ad market:

- Price efficiencies

- Fluidity during economic stress

- Digital-first campaigns (from legacy off-line publishers)

- Influencer marketing to have a greater attribution deliverable

- The video advertising marketplace is in for a turbulent few years

- Price-efficient ad product needed to offset TV’s lost impressions

- Linear video will continue to offer more inventory to third party sellers

In Summary, There Are No Guarantees in Life

Like the general economy or even the advertising marketplace, growth for brands is not inevitable. The expectation of endless growth should be tempered by the repeated lesson of history to the contrary. The market is capable of a collapse but, to-date, most of this is due to fear without an actual trigger.

Brands should plan with caution. Flexibility is required. This includes media and publisher selection based on who will work with you to cover flexibility requirements.

Unless a market-triggering event occurs, it’s not the time to reduce to publisher partners significantly, only to adjust your list to refined goals. Those goals should focus now more on hard metrics (sales, delivery, etc.) versus soft measures from branding and perception.

It’s not time to panic. Again, growth is not endless. We’re just re-learning lesson #1.

About the Author

John Spiropoulos, a special contributor to SMI Insights, has many years of experience on the buy- and sell-side of the advertising industry, including a past focus on both linear TV and digital media.